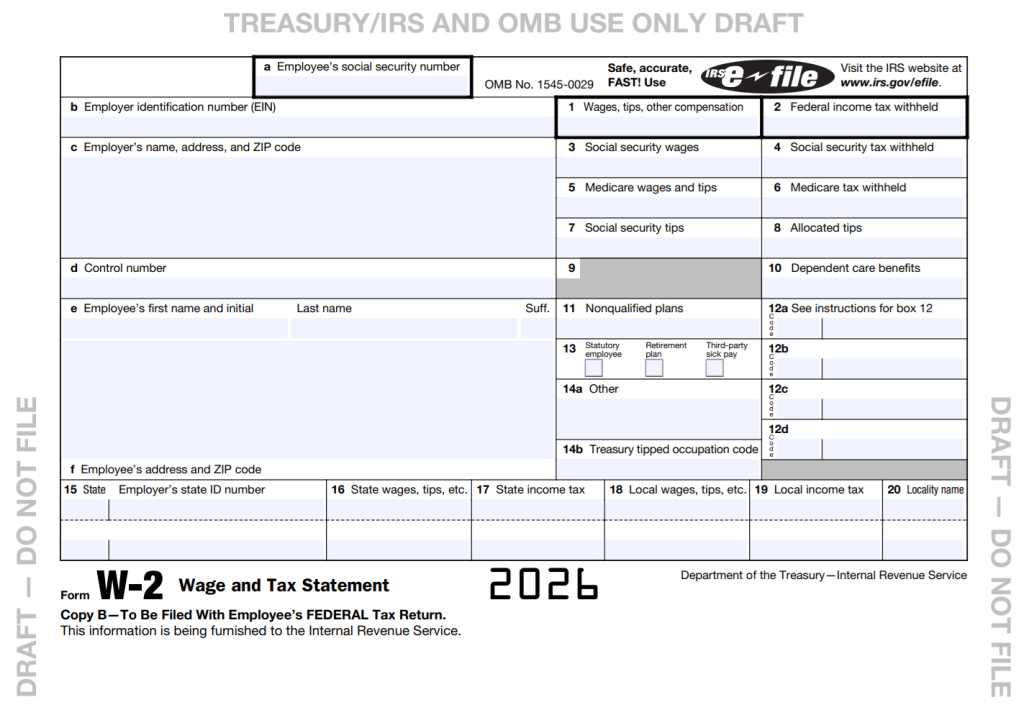

IRS Unveils 2026 Draft W-2 Form with Trump Tax Law Provisions

The IRS released a draft W-2 form for 2026 on Aug. 15 that takes into account tax provisions in the One Big Beautiful Bill Act for deductions related to tip income and overtime pay.

The IRS released a draft W-2 form for 2026 on Aug. 15 that takes into account tax provisions in the One Big Beautiful Bill Act for deductions related to tip income and overtime pay.

The IRS announced earlier this month that, as part of its phased implementation of President Donald Trump’s tax-and-spending law, there won’t be changes to certain information returns or withholding tables for tax year 2025 pertaining to the new law. However, the agency has yet to clarify how employers should report overtime and tip income for 2025.

Related article: IRS Says No Changes Needed for Individual Information Returns or Withholding Tables for 2025

Let’s take a look at some of the potential changes for the 2026 W-2, Wage and Tax Statement, as indicated in the newly released draft form.

New Box 12 codes

In the employee instructions for the 2026 draft W-2, three new codes have been included for Box 12. The Box 12 codes are used to report various compensation and benefits amounts on an employee’s W-2. The three additional codes are:

TA: Employer contributions to your Trump account.

TP: Total amount of qualified tips. Use this amount in determining the deduction for qualified tips on Schedule 1-A (Form 1040).

TT: Total amount of qualified overtime compensation. Use this amount in determining the deduction for qualified overtime compensation on Schedule 1-A (Form 1040).

Under the new law, babies born between Jan. 1, 2025, and Dec. 31, 2028, will be automatically enrolled in a “Trump account” with a one-time $1,000 federal contribution. Contributions to a Trump account—which are nondeductible, so made from after-tax funds—are capped at $5,000 a year, and this figure will be indexed to inflation starting in 2027.

Employers may choose to contribute up to $2,500 either directly to the employee or the employee’s dependent, according to law firm Littler Mendelson. This contribution will count toward the annual $5,000 limit and be indexed to inflation beginning in 2027. Such contributions won’t be included in the employee’s gross income.

The “no taxes on tips” provision in the OBBBA stipulates that tipped income under $25,000 per year will be tax-deductible starting with the 2025 filing year. The provision expires after 2028.

The Treasury Department is required to publish a list of occupations eligible for the tips deduction by Oct. 2, 2025 (within 90 days of the OBBBA’s enactment into law). A taxpayer must have a Social Security number to qualify for the tips deduction.

In addition, the Trump tax law has a “no tax on overtime” provision. Overtime pay can be deducted—up to $12,500 for individual filers or $25,000 for married couples filing jointly—beginning with the 2025 tax year. The provision phases out for those with income above $150,000 or $300,000 for couples. It ends in 2028.

Related article: IRS Explains New Trump Tax Law Deductions for Workers, Seniors

The currently nonexistent IRS Schedule 1-A (Form 1040) “is anticipated to be the designated form for reporting the various deductions recently added to the previously concise list of items that are not deducted by an individual in the calculation of adjusted gross income, nor as an itemized deduction, but rather as an additional deduction utilized in computing taxable income under Internal Revenue Code Section 63,” noted Ed Zollars, CPA, in the Current Federal Tax Development blog.

Box 14 changes

Box 14 has been split into two parts:

14a – Other: What is now Box 14 on the W-2 form, employers can use Box 14a to report details such as state disability insurance taxes withheld, union dues, uniform costs, health insurance premiums deducted, nontaxable income, or educational assistance payments.

14b – Treasury tipped occupation code: This field is used to identify the employee’s tipped occupation, as required under the OBBBA. The code links to the employee’s qualified tips reporting.

According to the IRS instructions, “Employers use this box [14b] to report the Treasury Occupation Code for your tipped occupation. Use this code in reporting the deduction for qualified tips on Sch. 1-A (Form 1040).”

“The mention of Schedule 1-A suggests that all these deductions will be reported on a new schedule, with the aggregate of such deductions subsequently carried forward to Form 1040,” Zollars wrote. “Given that the Draft 2025 Form 1040 has not yet been released, it is highly probable that this new form will debut with the 2025 Form 1040 filings.”